FIA WEBINAR SERIES RESOURCES

powered by DMI & Athene

-

FIA Webinar Series 1 of 3

Athene Fixed Index Annuities & 3 Important Customer Case Studies -

FIA Webinar Series 2 of 3

Athene BCA Suite of FIA Products -

FIA Webinar Series 3 of 3

Athene Protector 5

(For Broker Dealer Reps Only) -

The Power of

FIAs -

The Power of

LIFETIME INCOME -

The Power of

ACCESSIBILITY & CONTROL -

The Power of

TAX DEFERRAL -

The Power of

LOWER RISK -

The Power of

LEAVING A LEGACY

FIA Webinar Series 1 of 3

Athene Fixed Index Annuities & 3 Important Customer Case Studies

FIA Webinar Series 2 of 3

Athene BCA Suite of FIA Products

FIA Webinar Series 3 of 3

Athene Protector 5

(For Broker Dealer Reps Only)

The Power of FIAs

Today’s FIAs are fueled by the latest technologies and some of the world’s biggest brains and banks backing them up with intelligent design. But what does all this mean to you? It means finding the business opportunity by talking to your clients. It means becoming the FIA expert. It means working with a company like DMI that can elevate your business.

Preparing for retirement in today’s volatile markets presents challenges that past generations have never encountered. Today’s retirees need to anticipate and prepare for longer lifespans, increasing health care costs, an uncertain future for Social Security and the ever-present risk of taxes. In addition, unlike our parents and grandparents, many retirees today are not fortunate enough to have the benefit of a company pension with the assurance of lifetime income.

How Can You Help?

Talk with your clients. Let them know there are options to:

• Get Guaranteed Income for LIFE

• Grow & Accumulate wealth with no market risk

• Leave a Legacy

Fixed Index Annuities Brochure

Use this brochure with your clients to help them understand the power of FIAs. Speak with your DMI consultant to see if you qualify to have this brochure branded to your company.

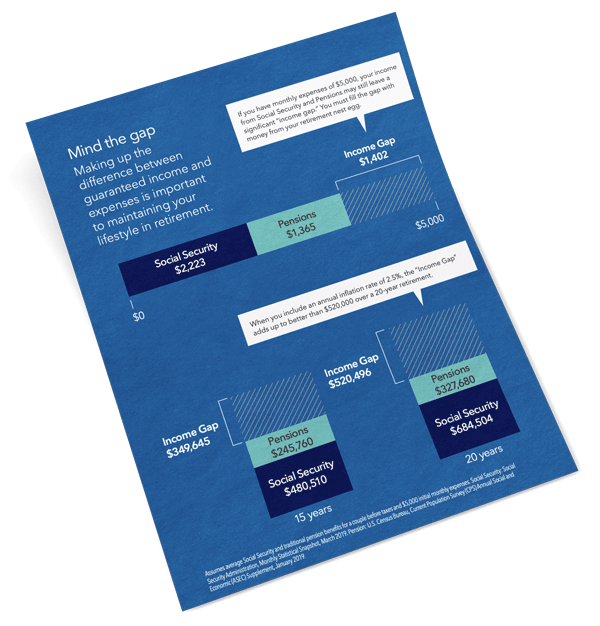

The Power of LIFETIME INCOME

For most, Social Security will not be enough to fund retirement. More and more, retirees need to rely on their personal savings to help meet everyday living expenses. Most financial experts recommend that consumers ensure basic needs are covered with a guaranteed source of income (rather than relying on funds that are subject to the ups and downs of a volatile market).

FIAs are long term retirement income products issued by insurance companies. Consumers want the security of guaranteed lifetime income they can’t outlive, backed by the financial strength of insurance companies. Annuities provide that assurance, so money is there when it is needed, no matter what the markets do.

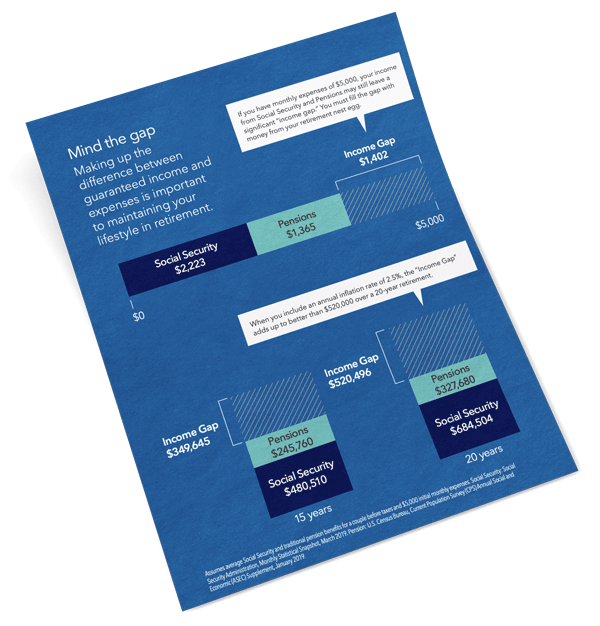

Income to Last as Long as Retirement Does

Here’s a brochure on Athene Ascent Pro you can use with clients. It’ll help explain Income Gaps and creating income streams that’ll last a lifetime.

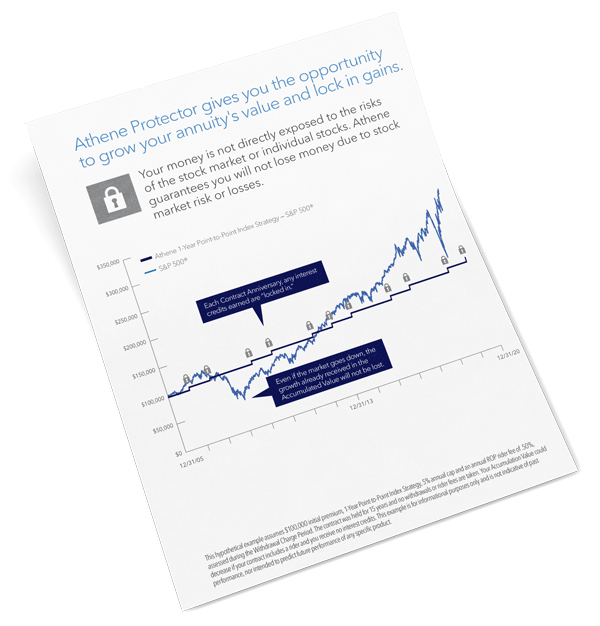

The Power of ACCESSIBILITY & CONTROL

Most annuities permit you to withdraw up to 10% of your annuity value every year without penalty, so clients don’t lose control of their money. Subject to any return of premium riders and surrender penalties, clients can further make withdrawals when/if necessary.

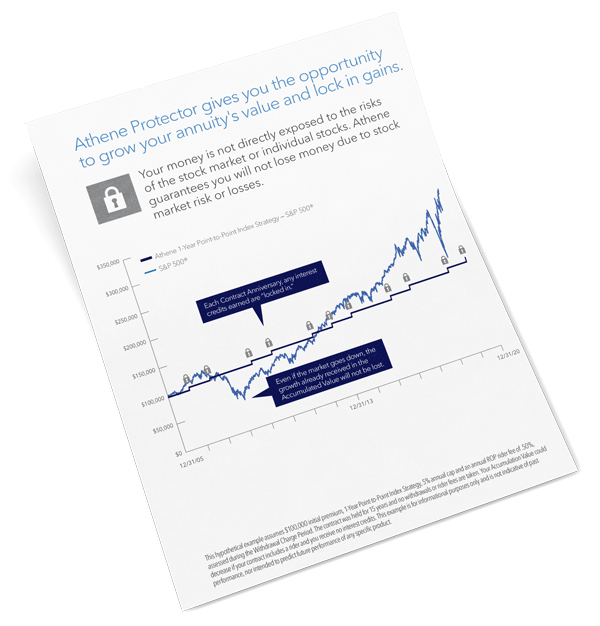

Plan For Flexibility

Here’s a download about Athene Protector 5 to help you explain the process. This page of the brochure will help you tell the story & give your clients something to visualize.

The Power of TAX DEFERRAL

Interest in an annuity is accrued on a tax-deferred basis. Any growth in the annuity from year-to-year will not be taxed, allowing your money to accumulate faster. Taxes will be paid at the time funds are withdrawn. For many, this can mean paying fewer taxes, since they may retire in a lower tax bracket due to decreased income in retirement.

Additionally, annuity income is not counted as income for the sake of determining the portion of your Social Security benefits that may be taxable, so they can be an integral part of a tax-efficient distribution plan in retirement.

FIA Strategy Brochure

Take a look at this client-facing brochure that discusses the advantages of tax deferment. Then speak with your DMI consultant to see if you qualify to have this brochure branded to your company.

The Power of LOWER RISK

Because money is never tied to directly to the stock market, there is no direct market risk. Most FIAs have “floors” and the ability to lock in gains.

Here’s a download about Athene Protector 5 to help you explain the process. This page of the brochure will help you tell the story & give your clients something to visualize.

The Power of LEAVING A LEGACY

We all know the greatest transfer of wealth in history is here. This is a HUGE opportunity for your business since nearly 45 million U.S. households will transfer more than $68 trillion over the next 25 years1.

Take this opportunity to:

- Retain more assets

- Provide a solution for younger clients receiving an inheritance

- Discuss opportunities with Attorneys & CPAs

Watch this video on the Athene BCA 2.0® & the Great Wealth Transfer Opportunity to gain 2 useful sales ideas for our #1 selling FIA.

Topic Menu:

- Webinar

- The power of FIAs

- The power of LIFETIME INCOME

- The power of ACCESSABILITY & CONTROL

- The power of TAX DEFERRAL

- The power of LOWER RISK

- The power of LEAVING A LEGACY

The Power of FIAs

Today’s FIAs are fueled by the latest technologies and some of the world’s biggest brains and banks backing them up with intelligent design. But what does all this mean to you? It means finding the business opportunity by talking to your clients. It means becoming the FIA expert. It means working with a company like DMI that can elevate your business.

Preparing for retirement in today’s volatile markets presents challenges that past generations have never encountered. Today’s retirees need to anticipate and prepare for longer lifespans, increasing health care costs, an uncertain future for Social Security and the ever-present risk of taxes. In addition, unlike our parents and grandparents, many retirees today are not fortunate enough to have the benefit of a company pension with the assurance of lifetime income.

How Can You Help?

Talk with your clients. Let them know there are options to:

• Get Guaranteed Income for LIFE

• Grow & Accumulate wealth with no market risk

• Leave a Legacy

Fixed Index Annuities Brochure

Use this brochure with your clients to help them understand the power of FIAs. Speak with your DMI consultant to see if you qualify to have this brochure branded to your company.

The Power of FIAs

Today’s FIAs are fueled by the latest technologies and some of the world’s biggest brains and banks backing them up with intelligent design. But what does all this mean to you? It means finding the business opportunity by talking to your clients. It means becoming the FIA expert. It means working with a company like DMI that can elevate your business.

Preparing for retirement in today’s volatile markets presents challenges that past generations have never encountered. Today’s retirees need to anticipate and prepare for longer lifespans, increasing health care costs, an uncertain future for Social Security and the ever-present risk of taxes. In addition, unlike our parents and grandparents, many retirees today are not fortunate enough to have the benefit of a company pension with the assurance of lifetime income.

How Can You Help?

Talk with your clients. Let them know there are options to:

• Get Guaranteed Income for LIFE

• Grow & Accumulate wealth with no market risk

• Leave a Legacy

Fixed Index Annuities Brochure

Use this brochure with your clients to help them understand the power of FIAs. Speak with your DMI consultant to see if you qualify to have this brochure branded to your company.

The Power of LIFETIME INCOME

For most, Social Security will not be enough to fund retirement. More and more, retirees need to rely on their personal savings to help meet everyday living expenses. Most financial experts recommend that consumers ensure basic needs are covered with a guaranteed source of income (rather than relying on funds that are subject to the ups and downs of a volatile market).

FIAs are long term retirement income products issued by insurance companies. Consumers want the security of guaranteed lifetime income they can’t outlive, backed by the financial strength of insurance companies. Annuities provide that assurance, so money is there when it is needed, no matter what the markets do.

Income to Last as Long as Retirement Does

Here’s a brochure on Athene Ascent Pro you can use with clients. It’ll help explain Income Gaps and creating income streams that’ll last a lifetime.

The Power of ACCESSIBILITY & CONTROL

Most annuities permit you to withdraw up to 10% of your annuity value every year without penalty, so clients don’t lose control of their money. Subject to any return of premium riders and surrender penalties, clients can further make withdrawals when/if necessary.

Plan For Flexibility

Here’s a download about Athene Protector 5 to help you explain the process. This page of the brochure will help you tell the story & give your clients something to visualize.

The Power of TAX DEFERRAL

Interest in an annuity is accrued on a tax-deferred basis. Any growth in the annuity from year-to-year will not be taxed, allowing your money to accumulate faster. Taxes will be paid at the time funds are withdrawn. For many, this can mean paying fewer taxes, since they may retire in a lower tax bracket due to decreased income in retirement.

Additionally, annuity income is not counted as income for the sake of determining the portion of your Social Security benefits that may be taxable, so they can be an integral part of a tax-efficient distribution plan in retirement.

FIA Strategy Brochure

Take a look at this client-facing brochure that discusses the advantages of tax deferment. Then speak with your DMI consultant to see if you qualify to have this brochure branded to your company.

The Power of LOWER RISK

Because money is never tied to directly to the stock market, there is no direct market risk. Most FIAs have “floors” and the ability to lock in gains.

Here’s a download about Athene Protector 5 to help you explain the process. This page of the brochure will help you tell the story & give your clients something to visualize.

The Power of LEAVING A LEGACY

We all know the greatest transfer of wealth in history is here. This is a HUGE opportunity for your business since nearly 45 million U.S. households will transfer more than $68 trillion over the next 25 years1.

Take this opportunity to:

- Retain more assets

- Provide a solution for younger clients receiving an inheritance

- Discuss opportunities with Attorneys & CPAs

Watch this video on the Athene BCA 2.0® & the Great Wealth Transfer Opportunity to gain 2 useful sales ideas for our #1 selling FIA.